Find IFSC: Your Ultimate Guide

In the digital age, where financial transactions are a part of daily life, knowing how to Find IFSC (Indian Financial System Code) is crucial. The IFSC code is a unique alphanumeric code that identifies a specific bank branch in India. This code is essential for online banking, wire transfers, and other electronic payments. In this comprehensive guide, we will explore the importance of the IFSC code, how to Find IFSC, and the various methods and tools available to locate this code easily and accurately.

What is an IFSC Code?

An IFSC code is an 11-character code assigned by the Reserve Bank of India (RBI) to identify bank branches participating in the NEFT (National Electronic Funds Transfer) system. The code is structured in the following format:

- The first four characters represent the bank code.

- The fifth character is always a '0' (reserved for future use).

- The last six characters denote the branch code.

For example, in the IFSC code SBIN0005900:

SBINrepresents the State Bank of India.0is the reserved character.005900represents the specific branch.

Why is the IFSC Code Important?

The IFSC code plays a vital role in online banking and electronic payment systems. Here are some reasons why knowing how to Find IFSC is essential:

- Accuracy in Transactions: Ensures that funds are transferred to the correct bank branch.

- Facilitates Electronic Payments: Required for NEFT, RTGS, and IMPS transactions.

- Enhances Security: Reduces the risk of errors in electronic fund transfers.

- Streamlines Banking Processes: Simplifies the process of sending and receiving money.

How to Find IFSC Code?

There are several methods to Find IFSC. Here are the most common and reliable ways:

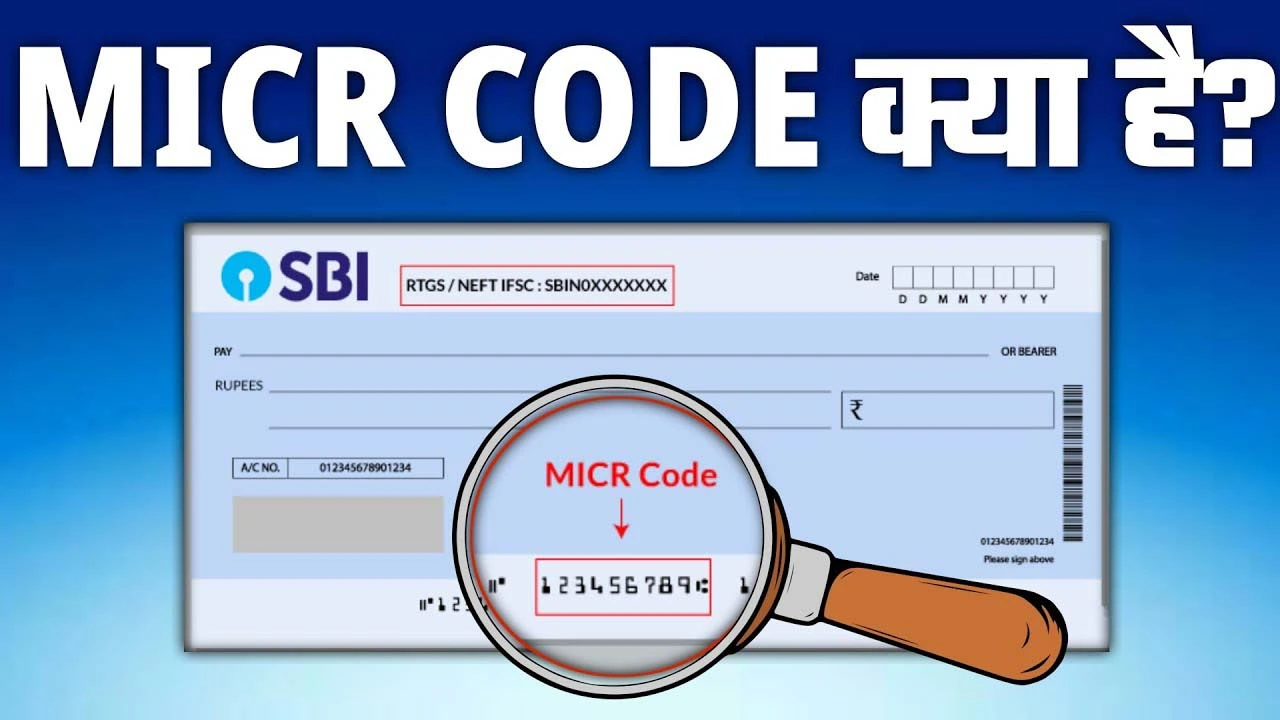

1. Bank Passbook or Cheque Book

The IFSC code is usually printed on the first page of your bank passbook or on the top left corner of cheque leaves. This is the easiest way to Find IFSC if you have your banking documents handy.

2. Bank’s Official Website

Most banks provide a tool on their official website to Find IFSC. You can search for the branch by entering details like the branch name, city, or state. This method ensures that you get the most accurate and up-to-date information.

3. RBI Website

The Reserve Bank of India’s official website maintains a comprehensive list of IFSC codes for all participating banks. You can use this resource to Find IFSC for any bank branch in India.

4. Third-Party Websites and Apps

Several websites and mobile applications are dedicated to helping users Find IFSC. These platforms provide user-friendly interfaces and search functionalities to make the process quick and easy. One such reliable resource is IFSC Code Master, which offers a simple way to search and verify IFSC codes.

5. Customer Care

If you are unable to access the internet or find the IFSC code through the above methods, you can always contact your bank’s customer care service. The representatives can help you Find IFSC for your specific branch.

Using the IFSC Code for Online Transactions

Once you know how to Find IFSC, using it for online transactions is straightforward. Here are the steps to follow:

- Log in to Your Online Banking Account: Use your credentials to access your online banking portal.

- Navigate to the Fund Transfer Section: Look for options like NEFT, RTGS, or IMPS.

- Enter Beneficiary Details: Provide the beneficiary’s name, account number, and the IFSC code of their bank branch.

- Verify Details: Double-check the information to avoid errors.

- Complete the Transaction: Follow the prompts to complete the transfer.

Common Mistakes to Avoid

When you Find IFSC and use it for transactions, be mindful of these common mistakes:

- Incorrect Code: Ensure that the IFSC code is correct and corresponds to the beneficiary’s bank branch.

- Outdated Information: Use reliable sources to Find IFSC to avoid using outdated or incorrect codes.

- Typos: Double-check the IFSC code for any typos or errors before proceeding with the transaction.

The Role of IFSC in Financial Inclusion

The IFSC code not only facilitates smooth financial transactions but also plays a significant role in financial inclusion. By ensuring that funds are transferred accurately and securely, the IFSC code helps bring banking services to remote and underserved areas. Understanding how to Find IFSC empowers individuals and businesses to participate fully in the digital economy.

Advanced Tools to Find IFSC

With advancements in technology, there are now sophisticated tools and platforms available to Find IFSC effortlessly. Some of these include:

- IFSC Code Master Website: This platform offers a comprehensive database of IFSC codes, along with an intuitive search function. Visit IFSC Code Master to quickly Find IFSC for any bank branch in India.

- Banking Apps: Many banks have integrated IFSC code finders into their mobile apps, making it convenient for users to Find IFSC on the go.

- Voice Assistants: Some voice-activated assistants can help you Find IFSC by simply asking for the IFSC code of a specific bank branch.

Conclusion

Knowing how to Find IFSC is essential for anyone involved in electronic banking and financial transactions in India. The IFSC code ensures that funds are transferred accurately and securely, making it a cornerstone of the country’s banking infrastructure. Whether you use your bank passbook, the RBI website, third-party apps, or customer care, there are numerous ways to Find IFSC easily and accurately.

For a hassle-free experience, consider using reliable resources like IFSC Code Master to ensure that you always have the correct and up-to-date IFSC code for any bank branch. By understanding and utilizing the tools available to Find IFSC, you can enhance your banking experience and ensure seamless financial transactions every time.