The Ultimate Guide to HDFC Bank Credit Cards

Convenience and financial flexibility are crucial in the fast-paced world of today. One of the top financial institutions in India, HDFC Bank, is aware of this requirement and has been offering its clients a selection of credit cards that are suitable for various lifestyles. The world of HDFC Bank Credit Cards, their features, advantages, and how they can simplify your life will all be covered in this article.

- Every Lifestyle Has a Card:

In order to meet the various demands and preferences of its clients, HDFC Bank provides a wide selection of credit cards. There is an HDFC Bank credit card that's ideal for you, whether you're a regular traveler, a shopper, a foodie, or a movie fan. You can make the most of your card's benefits thanks to the many options.

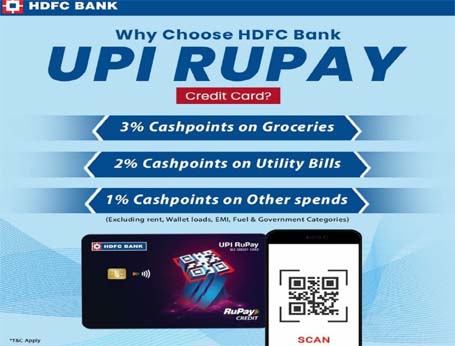

- Rewarding Spends:

The rewards program is one of the distinctive characteristics of HDFC Bank Credit Cards. You accumulate reward points with each purchase that may be exchanged for a number of advantages. These benefits can be used to purchases, meals, travel arrangements, or even cashback on your card statement. Your use of a credit card may qualify you for attractive discounts and promotions thanks to HDFC Bank's agreements with several companies and retailers.

- Travel Benefits:

If you often travel, HDFC Bank offers credit cards with features that can improve your trips. These cards come with perks including free airport lounge access, flight booking savings, and travel insurance. Additionally, HDFC Bank has agreements with significant airlines to provide cardholders exclusive perks.

- Contactless Technology:

HDFC Bank Credit Cards also use contactless technology to speed up and secure transactions. You can pay with only a tap, giving you a hassle-free and secure way to purchase.

- Loan facilities and EMI:

With the simple EMI conversion options offered by HDFC Bank Credit Cards, you may break down large purchases into manageable monthly payments. Spreading the expense of pricey products out this manner may be quite effective. You may also apply for pre-approved loans on your credit card, giving you immediate access to money when you need it.

- Online Account Management:

With their user-friendly mobile app and online banking interface, HDFC Bank Credit Card management is a snap. To control your spending, you may track your expenses, pay your bills, and set notifications.

Security:

HDFC Bank prioritizes security. They have strict security measures in place to prevent unauthorized usage of your card. They also offer 24/7 customer care to help you with any problems or inquiries.

For a variety of lifestyles, HDFC Bank Credit Cards provide endless convenience, benefits, and financial freedom. The credit cards from HDFC Bank are a great option if you're a regular traveler, a shopper, or just searching for a dependable and secure payment method. You may take advantage of a variety of discounts and bonuses thanks to their wide network of partners, making your business dealings more beneficial. So, as a dependable and practical choice, think about HDFC Bank Credit Cards if you're trying to improve your lifestyle and finances.