A Comparative Analysis of Indian and American Banking Systems

The banking systems in India and the United States share common goals of facilitating financial transactions, supporting economic growth, and ensuring financial stability. However, the two systems operate in distinct socio-economic and regulatory environments, leading to several differences in their structures and functions. In this article, we will explore the similarities and differences between Indian banks and American banks.

Similarities:

- Core Banking Functions: Both Indian and American banks provide essential banking services such as savings and checking accounts, loans, and investment products. They serve as intermediaries, connecting savers with borrowers and facilitating the flow of funds in the economy.

- Regulatory Framework: Both countries have established regulatory bodies to oversee their banking systems. In India, the Reserve Bank of India (RBI) regulates and supervises banks, while in the United States, the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) play key roles in regulating banks.

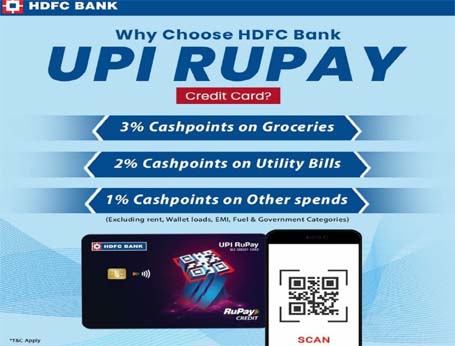

- Technological Integration: Indian and American banks have embraced technological advancements to enhance customer services and operational efficiency. Online banking, mobile apps, and digital payment systems are prevalent in both countries, reflecting a global trend toward digitization in the banking sector.

- Global Presence: Banks from both nations have expanded their operations internationally, establishing a global footprint. This expansion enables them to serve multinational corporations, facilitate cross-border transactions, and contribute to the interconnectedness of the global financial system.

Differences:

- Banking Structure: The structure of the banking systems differs significantly. In India, the banking sector includes public sector banks, private sector banks, and cooperative banks. In contrast, the United States has a mix of national banks, state-chartered banks, and credit unions. The diversity in the banking structure reflects variations in historical development and regulatory frameworks.

- Ownership and Control: The ownership and control of banks vary between the two countries. In India, the banking sector comprises public sector banks (majority government-owned), private sector banks (owned by private entities), and foreign banks. In the U.S., banks can be either commercial (for-profit) or community-oriented (non-profit), and ownership is diverse, including publicly traded corporations, privately held entities, and cooperatives.

- Deposit Insurance: The systems for deposit insurance differ. In the United States, the FDIC provides deposit insurance, guaranteeing the safety of deposits up to a certain limit. In India, the Deposit Insurance and Credit Guarantee Corporation (DICGC) performs a similar function, but the coverage and limits may differ from those in the U.S.

- Interest Rate Regulation: Interest rate regulations and monetary policy tools vary between the two countries. In India, the RBI plays a significant role in setting interest rates and implementing monetary policy. In the U.S., the Federal Reserve influences interest rates through open market operations, the discount rate, and reserve requirements.

While Indian and American banks share common objectives and face similar challenges, the differences in their banking systems stem from historical, cultural, and regulatory variations. Understanding these distinctions is crucial for policymakers, financial institutions, and consumers in navigating the unique landscapes of the Indian and American banking sectors. As both countries continue to evolve, ongoing collaboration and learning from each other's experiences can contribute to the further development and resilience of their respective banking systems.