NEFT vs RTGS vs IMPS: Which Fund Transfer Method Should You Use in 2025?

Online banking has revolutionized how we send money in India. But with multiple payment systems like NEFT, RTGS, and IMPS, it's easy to get confused.

Which one is faster? Which one is cheaper? Which should you choose for your next transaction?

In this 2025 guide, we’ll explain the key differences between NEFT, RTGS, and IMPS so you can pick the best method based on your needs.

💡 Quick Overview

| Method | Full Form | Best For | Availability | Speed |

|---|---|---|---|---|

| NEFT | National Electronic Funds Transfer | Scheduled payments | 24x7 | 2–4 hours (batch processing) |

| RTGS | Real Time Gross Settlement | Large transfers | 24x7 | Instant |

| IMPS | Immediate Payment Service | Urgent small transfers | 24x7 | Real-time |

🔹 What is NEFT?

NEFT stands for National Electronic Funds Transfer. It allows you to transfer funds from one bank account to another across India.

✅ Key Features:

No minimum or maximum transfer limit

Works in half-hourly batches

Now available 24x7, including holidays

Safe and cost-effective

📌 Ideal for:

Bill payments

Scheduled salary disbursement

Low-to-medium value transfers

🕒 Timing:

Available 24 hours, but transactions are processed in batches, not instantly.

🔸 What is RTGS?

RTGS stands for Real Time Gross Settlement, designed for high-value transactions.

✅ Key Features:

Minimum amount: ₹2,00,000

No upper limit

Real-time settlement

Ideal for urgent business transactions

📌 Ideal for:

Property payments

Corporate payments

Urgent large-value fund transfers

🕒 Timing:

Available 24x7, 365 days a year

🔹 What is IMPS?

IMPS stands for Immediate Payment Service, perfect for instant money transfers even during late nights or weekends.

✅ Key Features:

Minimum: ₹1

Maximum: ₹5,00,000 (may vary by bank)

Works 24x7, even on Sundays and holidays

Often used for mobile and UPI-based transfers

📌 Ideal for:

Emergency transfers

UPI payments

E-commerce and mobile transactions

🆚 NEFT vs RTGS vs IMPS – Comparison Table

| Feature | NEFT | RTGS | IMPS |

|---|---|---|---|

| Speed | 2–4 hrs | Instant | Instant |

| Availability | 24x7 | 24x7 | 24x7 |

| Minimum Limit | ₹1 | ₹2,00,000 | ₹1 |

| Maximum Limit | No limit | No limit | ₹5,00,000 (varies) |

| Type of Transfer | Batch | Real-time | Real-time |

| Suitable For | Routine transfers | High-value urgent | Fast low-value |

🔐 Is It Safe to Use These Methods?

Absolutely. All three methods are monitored by the Reserve Bank of India (RBI) and are completely secure when used with accurate account details and IFSC codes.

You can find the correct IFSC code of any bank branch using IFSCCodeMaster.com.

💡 Which One Should You Use?

🏦 Use NEFT if:

You're not in a rush

You want to schedule a transfer

You're sending routine payments or salaries

💸 Use RTGS if:

You're transferring ₹2 lakhs or more

You need real-time clearing

You're paying for big-ticket items (e.g. real estate, vehicles)

⚡ Use IMPS if:

You want an instant transfer, anytime

You're sending small or emergency payments

You’re using a mobile app or UPI

✅ Pro Tip:

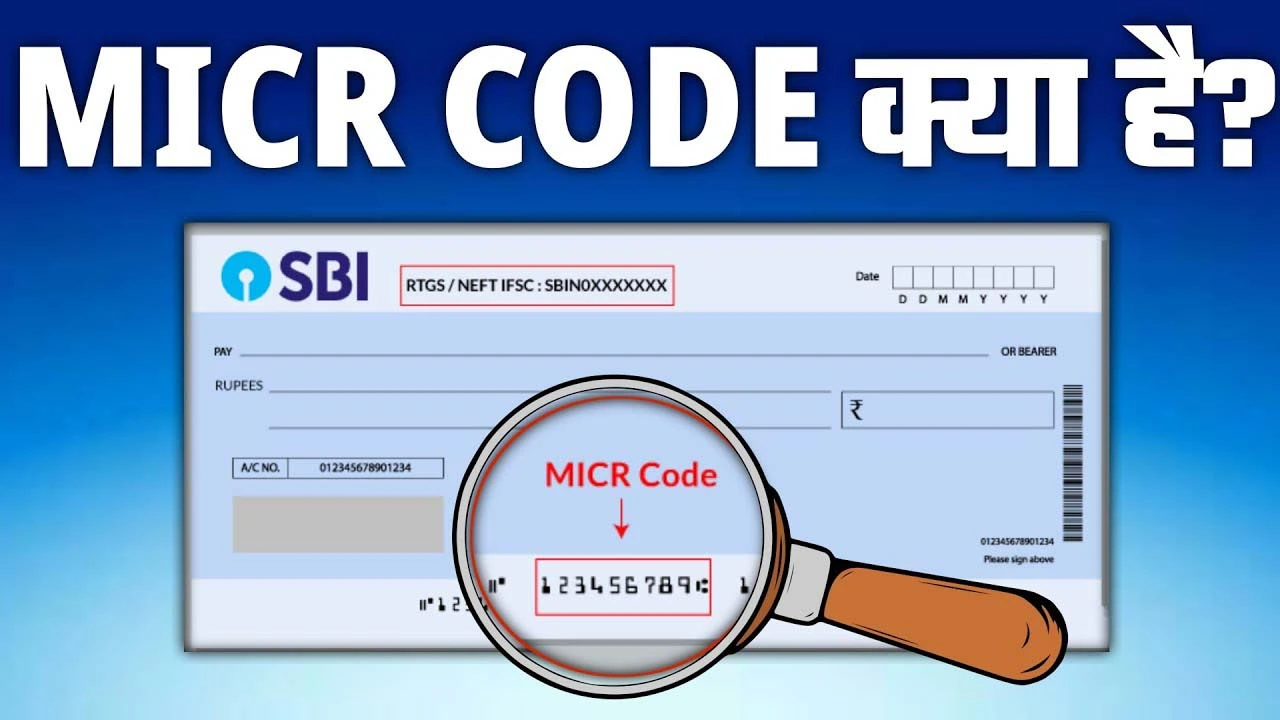

Before making any transfer, make sure to use the correct IFSC code. You can find it easily at:

Just select the bank, state, city, and branch to get accurate IFSC and MICR codes instantly.

🔚 Final Thoughts

Choosing between NEFT, RTGS, and IMPS depends on how fast, how much, and when you want to transfer money. With the banking system in India going fully digital, knowing these options helps you make smarter and safer choices.

Need help finding a bank's IFSC code for NEFT or RTGS?

Visit 👉 https://ifsccodemaster.com — your trusted IFSC search tool.