Banking Services in India vs. Banking Services in China: A Comparative Analysis

Banking services are the backbone of any economy, playing a pivotal role in driving financial inclusion, economic growth, and facilitating everyday transactions. In the context of global economies, India and China are two of the largest and most influential nations, with thriving banking sectors that cater to millions of customers. Despite sharing geographical proximity, the banking services in India and China differ in several key aspects such as their banking models, technological advancements, regulatory environments, and access to services. This article provides a comprehensive comparison of the banking services in both countries, highlighting their unique features, challenges, and innovations.

Overview of Banking Services in India

India's banking sector is one of the largest and most diversified in the world. The banking system in India is primarily categorized into public sector banks, private sector banks, foreign banks, and cooperative banks. The Reserve Bank of India (RBI) is the central regulatory authority that oversees the banking industry and formulates policies to ensure financial stability and inclusivity.

1. Banking System Structure

India’s banking system is heavily dominated by public sector banks, which hold a significant share of the market. Some of the major public sector banks include the State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda. These banks have a widespread presence, especially in rural and semi-urban areas, ensuring that banking services reach the farthest corners of the country.

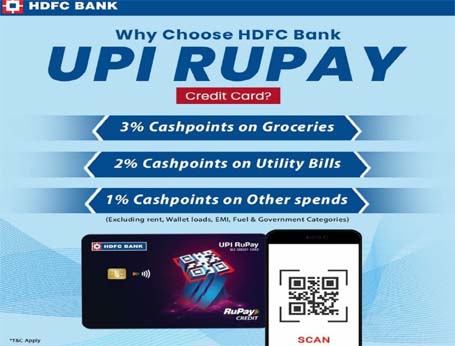

Private sector banks such as HDFC Bank, ICICI Bank, and Axis Bank are also major players in India’s banking landscape. They have established themselves in urban areas with a focus on technology-driven services and customer-centric solutions. Foreign banks, including HSBC and Standard Chartered, have a smaller footprint but cater to high-net-worth individuals and corporate clients.

2. Financial Inclusion and Digital Banking

Over the years, India has made remarkable progress in promoting financial inclusion, especially in rural areas. The government’s Pradhan Mantri Jan Dhan Yojana (PMJDY) initiative, launched in 2014, aims to provide access to banking services for the unbanked population by opening no-frills bank accounts for millions of people.

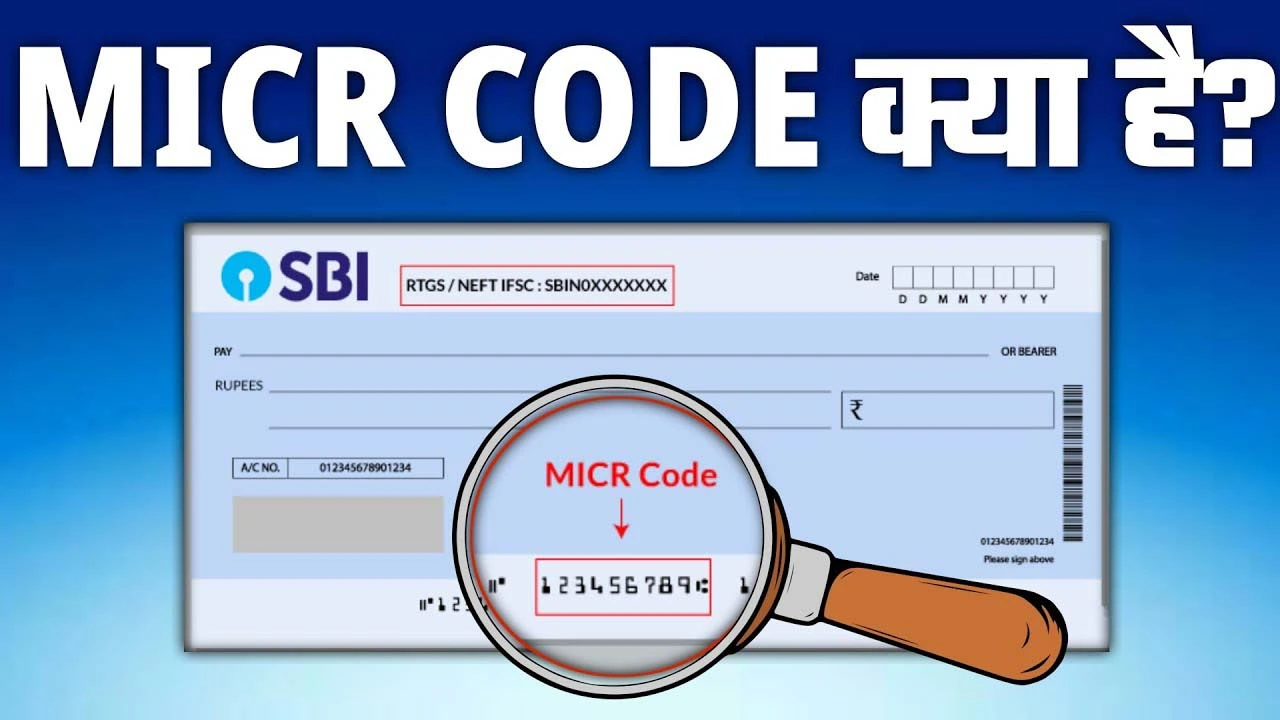

The rapid adoption of digital banking has transformed the Indian banking sector. Digital platforms such as UPI (Unified Payments Interface), mobile banking apps, and net banking have become mainstream. The Digital India initiative, along with government-backed schemes like Aadhaar, has enabled greater penetration of banking services, making transactions easier, faster, and more secure.

3. Regulatory Framework and Challenges

The Reserve Bank of India (RBI) plays a crucial role in regulating and supervising the banking sector. It sets monetary policies, manages inflation, and ensures financial stability. The introduction of the Goods and Services Tax (GST) and the implementation of the Insolvency and Bankruptcy Code (IBC) have streamlined the banking and financial sectors.

However, India’s banking system faces several challenges, including non-performing assets (NPAs), cybersecurity concerns, and gaps in financial literacy. Although India’s banking penetration has increased significantly, there are still many individuals and businesses that remain excluded from the formal banking system, especially in remote areas.

Overview of Banking Services in China

China, the world’s second-largest economy, has a banking system that is unique in its structure and operations. The banking industry in China is heavily dominated by state-owned banks, and the government plays a significant role in regulating and overseeing the sector. The People’s Bank of China (PBOC) is the central bank responsible for formulating monetary policies, managing inflation, and stabilizing the currency.

1. Banking System Structure

China’s banking sector is primarily comprised of four major state-owned banks: Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Bank of China (BOC), and Agricultural Bank of China (ABC). These banks have extensive branch networks and dominate both the retail and corporate banking sectors.

In addition to state-owned banks, China also has a growing number of private banks and joint-stock commercial banks. Some notable private banks in China include Ping An Bank and Bank of Communications. However, private banks still face restrictions in terms of scale and regulatory challenges.

2. Financial Inclusion and Digital Banking

China has made remarkable progress in terms of financial inclusion, with more than 80% of the adult population having access to formal financial services. The rapid urbanization and adoption of mobile technologies have contributed to the widespread use of digital banking. The growth of mobile payment platforms such as Alipay and WeChat Pay has revolutionized the way consumers conduct transactions.

China has also been a pioneer in the development and adoption of fintech solutions, such as online lending, digital wallets, and blockchain technology. The country’s state-run and private banks have integrated these technologies into their operations, creating a seamless and highly efficient banking experience for customers.

3. Regulatory Framework and Challenges

The People’s Bank of China (PBOC) closely regulates the banking sector, ensuring that state-owned banks maintain a dominant market position. The regulatory framework in China is characterized by a high degree of state control, and the government is actively involved in guiding credit flows to strategic sectors.

Despite its impressive growth, China’s banking system faces significant challenges. The country’s banking industry is burdened by high levels of corporate debt, which poses risks to financial stability. Additionally, the shadow banking sector in China has created systemic risks, as many non-bank financial institutions operate outside the formal banking system.

Key Differences Between Banking Services in India and China

1. Market Dominance and Ownership Structure

In India, the banking sector is a mix of public, private, and foreign banks, with public sector banks playing a dominant role. On the other hand, China’s banking system is heavily state-controlled, with the largest banks being state-owned institutions. This difference in ownership structure leads to differences in their approach to lending, risk-taking, and decision-making.

2. Digital Banking and Fintech Adoption

While both India and China have made strides in digital banking, China is far ahead in terms of fintech innovations. Platforms like Alipay and WeChat Pay are integral to the daily lives of Chinese consumers, enabling payments, investments, and financial services through mobile apps. In contrast, India’s digital banking infrastructure, although growing rapidly, is still catching up, with UPI being a significant milestone in this regard.

3. Government Role and Regulation

In China, the government plays a more active role in regulating and directing the banking sector, with state-owned banks receiving favorable policies. In India, while the government provides oversight through the RBI, there is greater diversity in ownership, and regulatory frameworks tend to focus more on maintaining competition and encouraging private sector participation.

4. Financial Inclusion

India has made considerable progress in promoting financial inclusion through schemes like PMJDY, which have brought millions of unbanked citizens into the formal financial system. However, there are still significant gaps in financial inclusion, especially in rural and underserved areas. China, on the other hand, has achieved higher levels of financial inclusion, with mobile payments and digital banking services being ubiquitous, even in remote regions.

Conclusion

Both India and China have made significant strides in enhancing their banking services, with an emphasis on expanding access to financial services and adopting digital technologies. While China’s banking system is more centralized and state-dominated, India has a more diverse banking landscape that encourages private sector participation and competition.

The future of banking services in both countries will be shaped by their ability to innovate, integrate new technologies, and address challenges such as financial inclusion, cybersecurity, and regulatory frameworks. As the global economy becomes increasingly digital, the banking services in India and China will continue to evolve, offering new opportunities for businesses, consumers, and the financial sector as a whole.