Do You Want to Get a Credit Card? Here’s Why You Should!

In today’s fast-paced world, financial flexibility is more than a luxury—it's a necessity. One tool that has transformed the way we manage our finances is the credit card. Whether you're shopping online, booking tickets, or simply trying to build your credit score, a credit card can be your best companion.

If you've ever thought about getting a credit card, you're not alone. Millions are turning to credit cards not just for convenience, but also for the rewards, offers, and financial control they bring. Let’s explore why you should consider getting one, especially a trusted option like the SBI Credit Card.

📌 What Is a Credit Card?

A credit card is a financial instrument issued by banks and financial institutions that allows you to borrow money up to a pre-approved limit. You can use it for purchases, bill payments, and more. Unlike debit cards, which deduct money directly from your bank account, credit cards let you spend now and pay later.

✅ Top Benefits of Using a Credit Card

1. Convenience and Safety

Carrying large amounts of cash is risky. Credit cards are widely accepted—both online and offline. You can use them at restaurants, shops, gas stations, and international sites with ease. Plus, many cards offer fraud protection and instant blocking options in case of theft.

2. Reward Points and Cashback

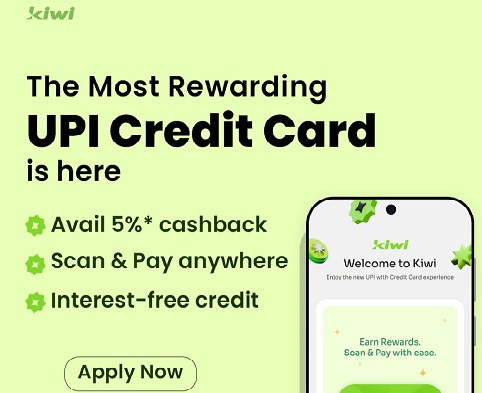

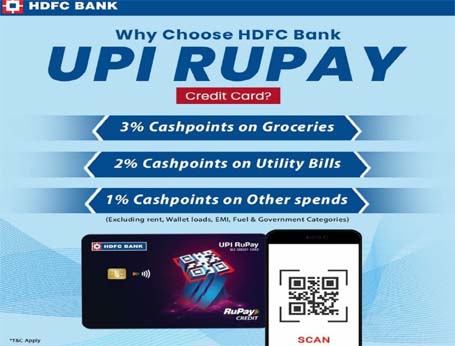

Most credit cards offer reward programs where you earn points on your spending. These points can be redeemed for gift vouchers, merchandise, or air miles. Some cards even offer cashback on specific categories like groceries or fuel.

👉 Want to know how to save on monthly expenses? Read our guide on Best Money Saving Tips for Indian Households.

3. Credit Score Improvement

Timely repayment of credit card dues boosts your CIBIL score, which is essential when applying for home loans, car loans, or personal loans. A good credit history builds your financial reputation.

4. Buy Now, Pay Later (BNPL)

Need to buy something urgent but short on funds? Credit cards allow you to split payments into EMIs, making big-ticket items more affordable.

5. Emergency Funds

In times of crisis, such as medical emergencies or unexpected travel, credit cards act as a lifesaver. You get access to immediate credit without having to apply for a loan.

6. Exclusive Offers and Discounts

From airport lounge access to discounts on dining, shopping, and travel—credit cards come with plenty of lifestyle benefits. SBI Cards, for example, often tie up with top brands and platforms for exclusive deals.

👉 Explore General Knowledge Questions for Competitive Exams to use your card for buying quality learning material online.

🔍 Who Should Get a Credit Card?

Credit cards are great for:

Working professionals looking to manage cash flow

Students or freshers wanting to build a credit history

Small business owners needing easy, short-term credit

Frequent travelers who want travel rewards and international access

However, you should only apply if you're confident about managing spending and repaying dues on time.

🏦 Why Choose SBI Credit Card?

SBI is one of the most trusted banks in India, offering a wide range of credit cards tailored to different needs:

SBI SimplySAVE Card – Great for shopping and daily expenses

SBI Card ELITE – Ideal for premium users with travel and luxury benefits

SBI IRCTC Card – Perfect for frequent train travelers

SBI BPCL Card – Cashback on fuel expenses

All SBI cards come with secure transactions, 24/7 customer support, and an easy online application process.

👉 Ready to experience the power of a credit card?

Click here to apply for an SBI Credit Card now

🧠 How to Use Your Credit Card Wisely

While credit cards offer many advantages, it’s essential to use them responsibly. Here are some tips:

Pay your bills on time to avoid interest and penalties

Spend within your credit limit to maintain a good credit score

Use auto-pay or reminders to never miss a due date

Track your expenses with mobile apps or bank statements

Avoid withdrawing cash using a credit card unless absolutely necessary (high interest)

👉 Check out How to Improve Your CIBIL Score in 30 Days for more smart credit habits.

❓ Frequently Asked Questions (FAQs)

Q1: Can I apply for a credit card online?

Yes. SBI offers a completely digital application process. You can apply online and receive your card quickly.

Q2: What documents are required?

You’ll typically need:

PAN Card

Aadhaar Card

Income proof (salary slip/ITR)

Bank statements

Q3: How do I pay my credit card bill?

You can pay via:

Net banking

Mobile apps

Auto-debit instructions

UPI or wallets

Q4: What is the annual fee for SBI cards?

It depends on the card. Some cards offer lifetime free options, while premium cards come with additional benefits for a nominal fee.

Q5: Can I convert purchases into EMI?

Yes, SBI allows you to convert eligible purchases into EMIs easily via internet banking or their app.

📝 Final Thoughts

Getting a credit card is a smart financial decision—if done right. It can simplify your transactions, give you access to exclusive rewards, and help you build a strong credit history.

The key lies in choosing the right card, using it wisely, and reaping the benefits it offers. If you’re ready to make your life easier and more rewarding, it’s time to get one.

👉 Apply for your SBI Credit Card here – Quick, safe, and secure!