How to improve your Credit Score

Improving your credit score is a worthwhile endeavor that can lead to better financial opportunities and lower borrowing costs. Here are some steps you can take to boost your credit score:

Check Your Credit Report: Start by obtaining a free copy of your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion). Review the reports for errors or inaccuracies, such as incorrect account information, late payments, or accounts you don't recognize. Dispute any discrepancies you find with the credit bureaus to have them corrected.

Make Timely Payments: Pay all of your bills on time, as your payment history is a significant factor in your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

Reduce Credit Card Balances: Aim to keep your credit card balances well below your credit limits. High credit card utilization (the ratio of credit used to credit available) can negatively impact your score. Ideally, aim to keep your utilization below 30% of your credit limit.

Don't Close Old Accounts: The length of your credit history plays a role in your credit score. Closing old accounts can reduce the average age of your credit history, which may have a negative impact. Keep your older accounts open, even if you don't use them frequently.

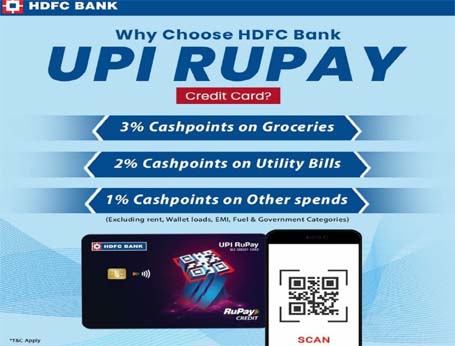

Diversify Your Credit Mix: A mix of different types of credit, such as credit cards, installment loans, and mortgages, can positively influence your credit score. If you don't have a diverse credit mix, consider responsibly opening new accounts as needed.

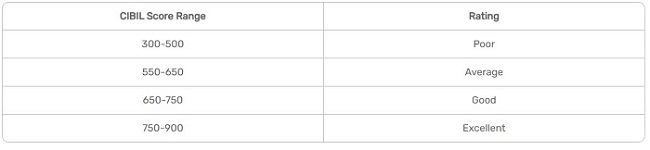

Credit Score Range:

Avoid Opening Too Many New Accounts: Opening multiple new credit accounts in a short period can lead to inquiries on your credit report and may lower your score. Apply for credit judiciously, and be cautious about opening new accounts for promotional purposes.

Negotiate with Creditors: If you're struggling with debt, consider reaching out to your creditors to negotiate more favorable terms or repayment plans. This can help you avoid further late payments and collections.

Become an Authorized User: If someone you trust has a credit card with a good payment history and low balances, you can ask to be added as an authorized user. This can potentially boost your credit score by including the positive account history on your credit report.

Be Patient: Building or improving your credit score takes time. Consistently following good credit practices over several months or even years is essential to seeing significant improvements.

Seek Professional Help: If your credit issues are complex, or if you're unsure how to proceed, you may want to consult with a credit counselor or a financial advisor for personalized guidance.

Remember that there are no quick fixes for improving your credit score. It requires responsible financial habits and a commitment to maintaining good credit over time. Regularly monitoring your credit and staying informed about your financial situation are crucial steps in managing and improving your credit score.

Know your Credit Score - Click Here